IAA Transportation 2022 Recap: eMobility, Auxiliaries and Power Electronics

The IAA Transportation trade show is massive, with over 1,400 exhibitors spread out across 10 pavilions and a central open-air section on the Deutsche Messe fairgrounds. IAA Transportation, a commercial vehicle-focused event, occurs every other year – alternating with IAA Mobility, a consumer automotive and personal mobility show. It has been four years since the IAA community has been able to showcase commercial vehicle technologies in person because of the 2020 Covid pandemic.

In four years, a lot has changed in the transportation industry, especially as electric vehicles have taken root with developments maturing towards series products. The technological landscape has also advanced. There are more diverse products on the market designed for eMobility applications and a higher degree of “system solutions” as opposed to mixing and matching individual components. In these regards, there were several trends observed and insights taken away from visiting the show.

European eMobility Market and Suppliers vs. North America

Two key objectives of visiting the IAA Transportation show were to get a sense of where the European eMobility market stands on the path to electrification and the state of technology and product offerings on the market.

What is unique about a large European trade fair is that it brings so many markets together and is an opportunity to gauge how each is performing and the underlying drivers of progress. As Europe tends to be more technologically progressive and further ahead than North America in eMobility adoption, insights gleaned can be a bellwether for the North American market.

During the show was the opportunity to discuss eMobility market activity amongst KEB colleagues representing Germany, France, Italy, the UK, and Belgium/Netherlands/Luxemburg. The consensus was that EV developments and adoption varied by country and government incentives are a driving factor as well as emission restrictions, but perhaps to a lesser degree. This helps explain why countries such as the Netherlands have been early EV adopters and has many EV vehicle builders. On the other hand, it provides an outlook on the limits of EV adoption growth for countries lacking incentives or emissions restrictions. By comparison, this would be similar to comparing many states in the US with California.

Another interesting aspect of visiting this tradeshow is that there tend to be more component manufacturers displaying. For electrified components, many are European companies established in designing and manufacturing power electronics and electric motors whose expertise comes from backgrounds working with industrial automation applications. These companies may not have well-known names within the automotive industry; but this industry is new to these devices, not the other way around.

For example, Germany is known for its many “hidden champions.” These small and medium-sized companies tend to be market leaders due to innovation, performance, and quality. But, the markets they excel in can be niche applications and these hidden champions may otherwise not be widely-known to the general public. So, that unassuming booth whose company you may have never heard of may in fact have the best-in-class products or solutions.

eMobility Everywhere

It wasn’t surprising to see electric vehicles at this show. In fact, most vehicles on display were electric or zero-emissions vehicles of some type (aside from the large mobile equipment in the open-air area) and of all varieties ranging from delivery vans to heavy-duty trucks and body equipment. Rather, it was surprising to actually see the few ICE vehicles on display…especially when competitors across the aisle had similar EV offerings. If there was any doubt beforehand, it became quite apparent…the future is electric.

Integrated Auxiliaries vs. Partner Solutions

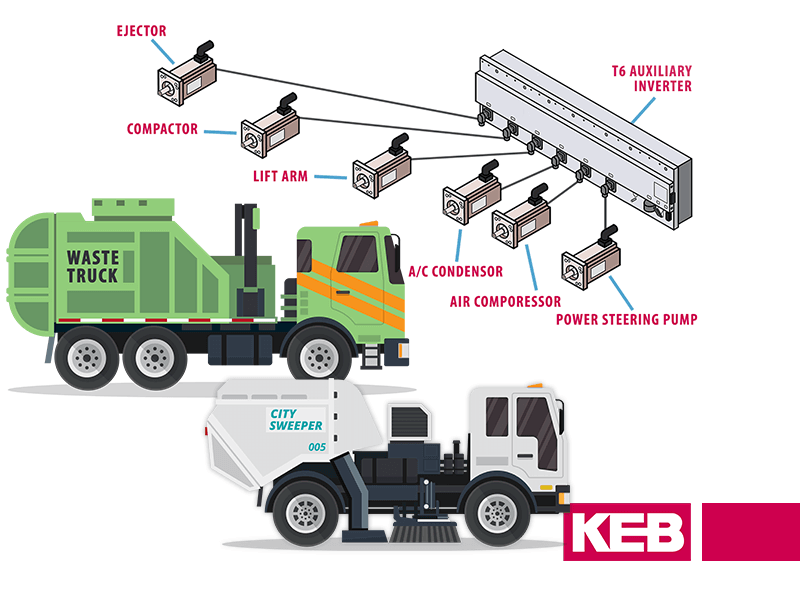

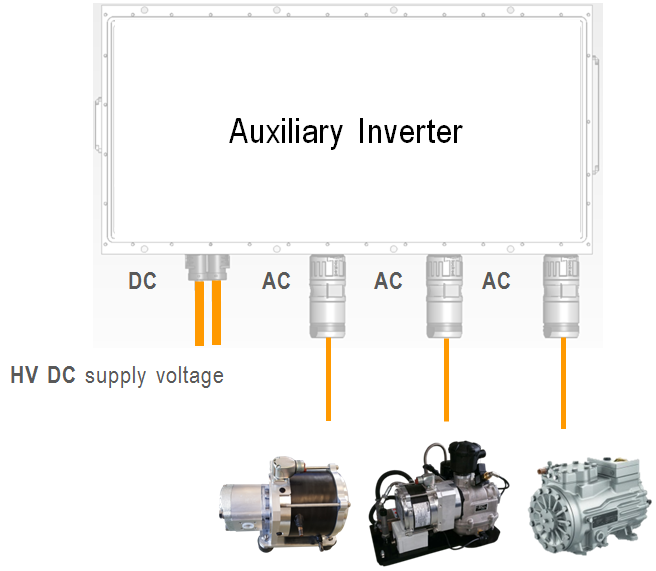

One noticeable trend was the surprising number of integrated auxiliary offerings now available. That is, pumps and compressors packaged with electric motor AND built-in power electronics. This certainly makes sense for aggregate manufacturers looking to provide vehicle builders with a single-source, compact, all-in-one solution.

This type of solution can also have its potential drawbacks. Although these are compact solutions, adding power electronics onto the motor increases the size of the unit. While this may only be several inches, that can be critical; especially for devices intended to be mounted under the hood where space is very limited. Another potential drawback is that an all-in-one device would mean that the aggregate (e.g. pump, compressor), motor, and power electronics are a fixed unit. It begs the question of whether the supplier is an expert in all three areas. And, if one component fails would the entire unit need to be replaced?

An alternative to integrated auxiliaries or sourcing each component individually is partner solutions where the individual component manufacturers have working relationships with other component suppliers to provide an auxiliary “system” solution. Here, the sum can be greater than the parts since the suppliers are experts with the know-how of their respective components and can collaborate to provide higher performance, higher efficiency system solutions.

An example of this is power-on-demand steering pump solutions which utilize inverter algorithms designed for optimal control of the motor based on the hydraulic system characteristics and operational state of the vehicle to provide the exact pressure and flow needed. Similar solutions can also be implemented for air compressor systems. These “smart” control solutions minimize power consumption by operating the system at its most efficient operating point based on the actual load demand with the additional benefit of reduced audible noise when operating below the nominal rated point.

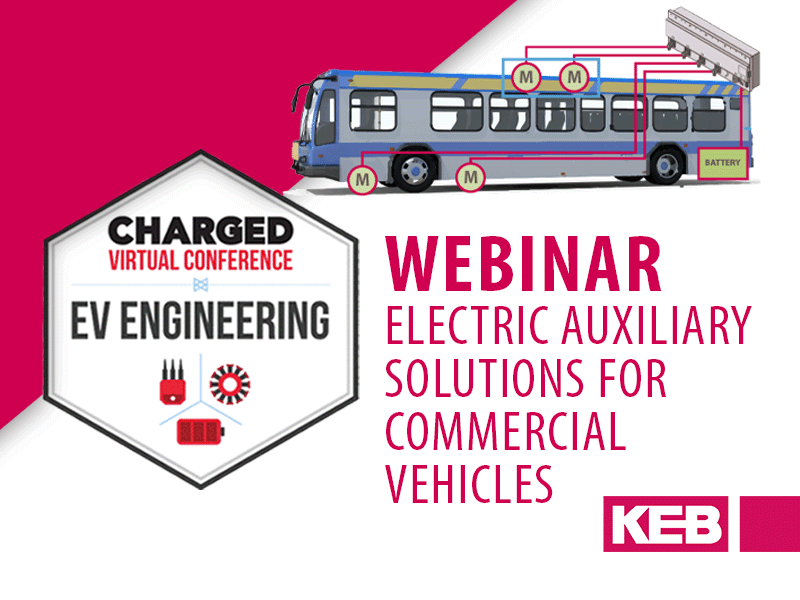

High Voltage vs. Low Voltage Auxiliaries

Auxiliaries such as power steering pumps and air compressors fall in the power range (typically 3.5 – 7kW) in between low voltage DC accessories including house loads such as lights or cabin A/C cooling fans and high voltage AC components such as the traction motor. Many of the auxiliary offerings on display at the tradeshow were of the low voltage DC variety. Although, that does not mean it is necessarily a better solution than high voltage AC solutions.

Low voltage systems are an easy first step into auxiliary electrification since fewer design considerations are needed for voltage safety and mitigating electrical noise. But, the low voltage means proportionally higher current (e.g. 100+ A for 24VDC vs. <15A for 400VAC) and thus larger wire sizes. Additionally, low voltage devices may also need a DC/DC converter (typical power rating 4 – 6kW) to step down from the high voltage battery power source.

High voltage AC auxiliaries were not absent from the show though. In fact, there were several examples of these solutions from partner companies installed on customer vehicles. Likewise, several other auxiliary manufacturers were also starting to offer high-voltage AC solutions. High voltage AC servo motors are quite similar in structure to brushless DC (BLDC) but can have higher efficiency, better performance, and lower noise from an operational standpoint. High voltage AC offerings are perhaps the next step for electrified auxiliaries but are still gaining ground against incumbent DC solutions.

Cybersecurity

Although the topic of cybersecurity did not come up all too frequently, it came up enough in discussions to understand that this will become a standard requirement in the future. Adoption is being driven by the standards UN ECE R155 and ISO/SAE 21434 for Cybersecurity Management and Engineering, with ECE R155 having a deadline of July 2024, which “will apply to all new vehicle types for type approval, and from July 2024 they will apply to all vehicles.”

The new standard affects not only OEMs but component manufacturers as well and goes beyond just the vehicle or component design to encompass an organization’s processes and management of cybersecurity risk. This is important to consider when selecting components and should be discussed with the manufacturer. Although most component manufacturers will not have this in place just yet, failure to have a roadmap to meet this requirement at this point could be a red flag. With all the new names and components popping up in this industry, it is a question worth asking.

Conclusion

Overall, attending the IAA Transportation tradeshow was very insightful, both in terms of understanding the state of the commercial vehicle eMobility developments and adoption in various regions as well as seeing how the technological landscape has changed and the current product offerings available on the market. It is surely a tradeshow worth paying attention to as the products and vehicles on display are state-of-the-art and the trends seen are an indicator of what’s to come in the near future for the transportation industry. What is clear, above all else, is that the future is electric.

Let's Work Together

Connect with us today to learn more about our industrial automation solutions—and how to commission them for your application.